Client:

CORPORACIÓN INTERUNIVERSITARIA DE SERVICIOS (CIS)

City of Medellín – Colombia

December 2021

“An application for the bank of opportunities, a project decreed by the government to offer credits to small entrepreneurs. We take care of systematizing all its services.”

Juan Felipe Salazar

CEO, DATION

Overview

Develop a query system for the bank of opportunities, which allows generating credit applications, accessing user information, facilitating the portfolio and application information.

Challenge

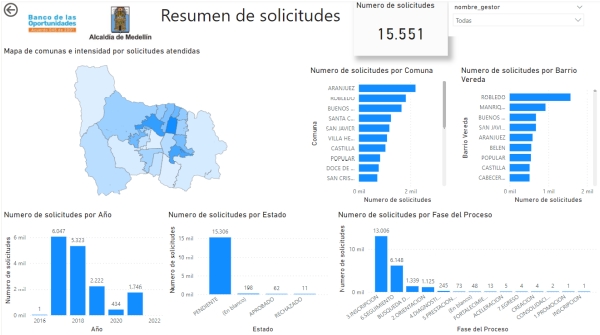

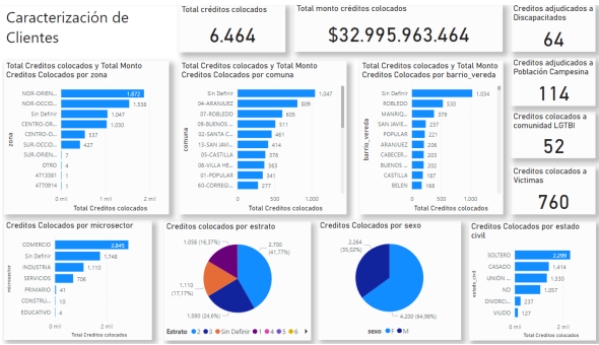

Integrate information from the Bank of Opportunities in the city of Medellin, offer online credit application services and manage data through management dashboards for decision-making.

Landing page

Design of a page that contains the application services and credit information with client authentication and registration.

Internal management application

Implementation of an application of set up credits, assign requests and manage queries and roles.

KPI’s and data management

Visualize KPI’s results in real time for credit management and decision making.

Solution

Develop a citizen information system that facilitates the management of public resources in accordance with current regulations and coordination with the cultural, artistic and heritage sectors.

Requirements

Definition of requirements (user stories) and services that are included in the application.

Developing, testing & deployment in production

Definition of solution architecture, development of functionalities, and execution of tests.

Development of management dashboards

Creation of the data model. Development of managerial dashboards with managerial functions and indicators.

Results

- Landing page deployed in production for the program of the Bank of opportunities.

- 2 management boards that allow the analysis of Bank data.

- Functional application in responsive version for any device.

- Credit simulation application.